The length of video games seems to be a hot topic lately. As somebody who plays video games on occasion, and probably reads too much about them, it’s an interesting discussion. This article at ArsTechnica was referenced heavily in video game media for a while, with Raptr writing a bit of a nonsensical rebuttal here, which showed that people on average only play a game for 7-8 hours no matter how long it is, an interesting but tangential point. Early 2013 speculation about the price of next-gen games going up provided additional kindling for the conversation, specifically whether it was worth it to pay $70 – $80 if games weren’t going to get any longer.

When considering the question, it’s important to define the scope – there are certainly more video games released each day today than ever before, across a wider range of platforms than ever before. But if the question is “have home console games gotten shorter”, ignoring iOS apps and Facebook games, then I think the answer is no.

I threw together the below charts based on two data sets: the VGChartz all-time sales list, and game length data from (appropriately) gamelengths.com. First I looked at the best-selling game for each year since 2000, and charted the length of the campaign. There are a number of caveats though; many of the top-sellers don’t have campaigns, and many came packaged with a console (inflating their sales numbers). For example, Wii Sports is the best selling game of all time according to VGChartz, but it doesn’t have what you could consider a “campaign”. Similarly, a sports title like Madden doesn’t have a real campaign either. So I ignored any game that didn’t have a length on gamelengths.com, and went to the next best-seller for the year. Also, console only (Xbox/Wii/PS etc.)

This is admittedly a clunky approach, and only answers the question as it relates to the single most popular games with a campaign each year (along with answering “how much has Call of Duty dominated the last half decade”). Also, Need for Speed Underground was the best-seller two years in a row? Where was I for that game? Gran Turismo 3 was actually the best seller in the year prior as well, but had no official campaign length to quantify. I can guarantee that represents a unique three year stretch in video game history where racing games were king, an era we aren’t likely to see repeated.

Anyway, the chart above doesn’t give us much of a pattern across time. Shooters tend to be in the 7-10 hour range, Action & Racing are in the 10-30 range, and RPGs (of which Zelda really should be classified) are 40+. It would be foolish to make a broad statement about game length based solely on which genre sold the most units in a single year, even more so because Call of Duty tends to actually suck up more total hours than any of the games on this list, if this chart is to be believed, showing that gamers spent 67 hours on average with Black Ops 1 in contrast to its 7 hour campaign.

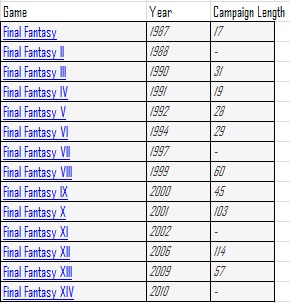

So let’s take a different approach. How about looking at established series in these established genres to track their progression over time? I, somewhat arbitrarily, picked Shooter, Action, and RPG as my genres, and Call of Duty, Assassin’s Creed, and Final Fantasy as the series to track, respectively. Here we go:

As sure as the sun rises, Activision releases a new entry into the Call of Duty series every fall. Call of Duty has barely moved over the past 9 years, sticking right at that 6-8 hour band where Raptr claims we simultaneously lose interest, but stick around for another 60 hours. I omitted a few where my source had no reliable campaign data, but I have a feeling it’s in the same range.

Similarly, Assassin’s Creed has been relatively consistent since it’s debut in 2007, adhering to that 20-30 hour mark. If anything, the first entry was something of a tech demo for the ps2, and it’s been easier to add in content since the basic engine was completed.

Besides the few entries here where I either have no data or the game had no campaign (XI and XIV were MMORPGs), the FF campaigns have actually trended upwards since the olden days, when cartridges likely limited the number of hours a developer could cram into a machine. Final Fantasy 3 should probably be in the all-time efficiency hall of fame, providing a 31 hour campaign on a cartridge that could only hold 512KB of data. For context, the images in this post alone take up 200kb of space, and they certainly don’t provide more than 2 minutes of entertainment!

So in terms of an empirical answer, it looks like no, home console games have not gotten shorter. If anything, the evidence suggests that increased storage capacity has yielded longer games in at least one genre (the RPG). And with the advent of broadband multiplayer, many games that are technically “short” (like Call of Duty), are actually played the longest (67 hours on average for Black Ops, according to Raptr, as one data point). We can also conclude that Shooters have gotten too popular, but at least they aren’t racing games. 🙂

You must be logged in to post a comment.